The Central Board of Direct Taxes (CBDT) has directed all taxpayers to link their Permanent Account Number (PAN) with their Aadhaar card. The rule applies across India and aims to simplify tax filing, prevent duplicate identities and improve transparency in financial records.

The government has made the linking process mandatory and set December 31, 2025 as the deadline for completion. Users can complete the process online through the official Income Tax e-filing portal to avoid their PAN becoming inoperative.

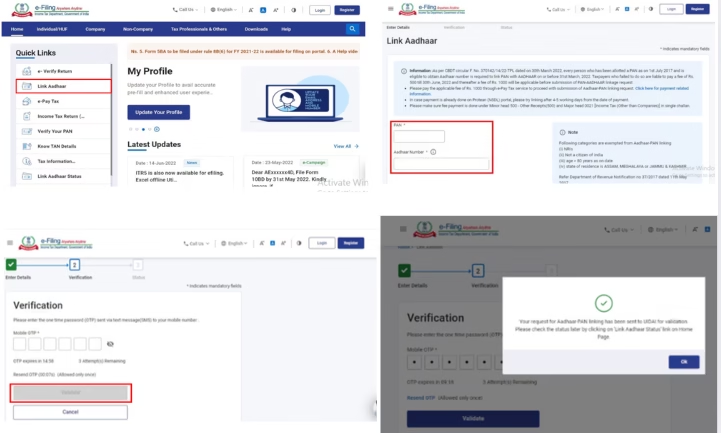

How to Link PAN With Aadhaar Online

Users can link their Aadhaar and PAN easily through the Income Tax Department’s online portal i.e incometax.gov.in. To do so, follow these steps:

- Go to the Income Tax e-filing portal at incometax.gov.in and click on “Link Aadhaar” under Quick Links.

- Enter your PAN and Aadhaar number correctly.

- Input the name and mobile number as per your Aadhaar record.

- Verify with the OTP (One-Time Password) sent to your Aadhaar-linked mobile.

- Submit the request. You will see a success message when the Aadhaar-PAN link is sent for validation.

- If you are linking after the deadline, you may need to pay the fee first and then submit the linking request.

It is important to ensure that the name, date of birth, and gender details match exactly on both documents to avoid rejection. For detailed instructions and screenshots, users can visit the official Income Tax Department guide here.

How to Check PAN- Aadhaar Link Status

Once the linking request is submitted, users can check its current status online by following the steps:

- Visit incometax.gov.in and select “Link Aadhaar Status” under Quick Links.

- Enter your PAN and Aadhaar numbers.

- Click “View Link Aadhaar Status” to see whether your Aadhaar is linked, pending or not linked.

If the two are successfully linked, the message “Your PAN is linked to Aadhaar” will appear. Users can also check their linking status via SMS. Type UIDPAN <12-digit Aadhaar> <10-digit PAN>

and send it to 567678 or 56161. A confirmation message will be received within seconds.

Why PAN- Aadhaar Linking Matters

Linking PAN with Aadhaar helps the government track financial transactions, reduce tax evasion and prevent duplicate PANs. It also makes it easier for individuals to file income tax returns and carry out banking or investment activities without interruptions. Hence, linking both documents is essential for continued access to financial services. What’s your take on this?